If you are Canadian Company providing services to US Companies that has been asked to fill out a W-8 BEN-E form you may be wondering why. You may also be wondering how to complete it. This article walks an active business and Canadian corporation in Canada offering consulting services to a US company on completing this form. This is only relevant to non-financial entities such as a management consultant.

What is it?

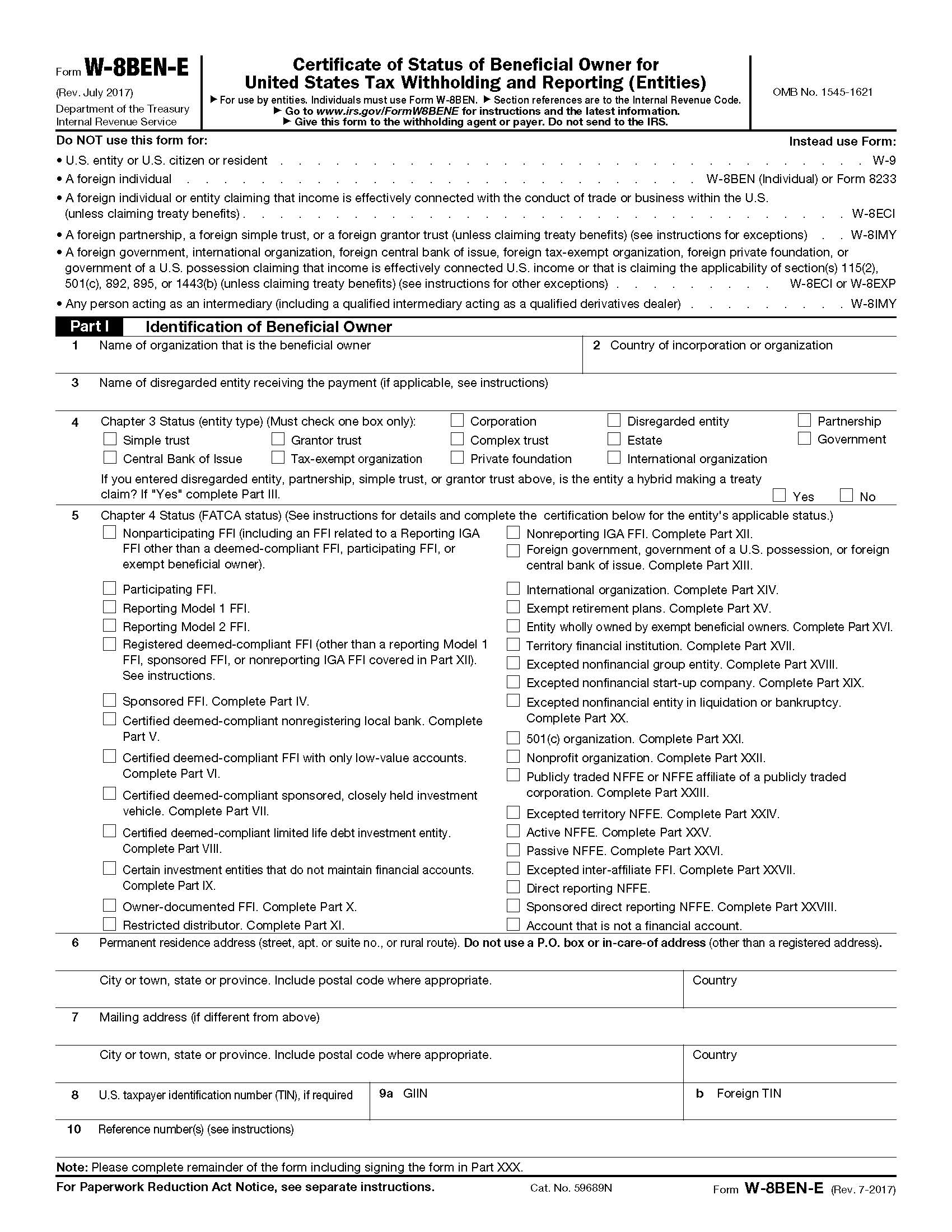

The W-8 BEN-E form is provided by the IRS (the US Federal Tax Agency similar to the Canada Revenue Agency). It is used by foreign entities to document their status for purposes of treaty eligibility consideration on withholding tax. The basic explanation is that if a US company pays your Canadian company they are required to withhold tax on the amount paid unless there is treaty exemption on this.

Should I complete it?

If you do not provide this filled out document your client will have to take a 30% withholding tax on any amounts you receive. If you are receiving the money for services rendered as an active Canadian business then you likely are providing services that are exempt from tax under the Active NFFE category (Active Non-Financial Foreign Entity).

You must ensure you complete the correct form for this. As a Canadian Controlled Private Corporation you complete the form W-8 BEN-E form. The W-8 BEN form is for individuals. If you get the form for individuals for your corporation, you will need to ask them for the company form.

How do I complete it?

This can of course vary by your specific details and transactions but for most Canadian companies offering only consulting services this is generally how you would complete it. There is a lot of detail in the form to confirm this is the case or you can also consult your accountant.

These are only to help give you an idea of what you would fill in. Please ensure you read the details to confirm you fit into these categories.

Part I

You will complete the form using your corporations name and business address. Some portions will be N/A but you will have to choose what type of entity you are. If you are an active small business incorporated in Canada offering services to a US company then you likely will complete as a “Active-NFFE” . This means you are an active non-financial foreign entity. Then you will complete Part XXV.

Part II

Typically not applicable if you fall into the above.

Part III

Check “Canada” and Check “Company with an item of income that meets active trade or business test”.

Part IV-Part XXIX

These parts are generally N/A but check if your situation falls into one. These areas generally require professional advice if you do.

Part XXV

Check

Sign and Send to Client

Confirm the above agree to your situation from the form. If there are concerns consult professional advice as this is a legal document and you do not want to misrepresent your company. However, the above is the most company situation in our experience. If it agrees with your situation, then you can sign and provide back to your client for their records. They will then pay you the full amount for your services without a holding tax.

The above was prepared using a revised July 2017 W-8BEN-E form and is only applicable to the parts of that form specific form. If you are receiving other than active business income amounts for services rendered the above is not relevant to you or if there are other special circumstances. Consult the instructions for the form on how to complete and/or seek professional advice.

You can get a W-8 BEN-E form from the IRS website here: https://www.irs.gov/pub/irs-pdf/fw8bene.pdf

Virtual Heights Accounting is a CPA firm that operates in the virtual world. We provide virtual accounting, tax, Virtual CFO and Controller services for your growing Company. Contact us at www.vhaccounting.ca/contactus or follow our blog on your chosen social media source. This blog is intended for general use and understanding and does not replace direct professional advice.