Claiming GST/HST on a Company Vehicle in Canada: What You Need to Know

Claiming GST/HST on a company vehicle in Canada can deliver meaningful tax savings for your corporation. However, you only receive those savings if you follow the rules correctly. The Canada Revenue Agency (CRA) applies strict criteria to vehicle-related input tax credits (ITCs), and missing even one requirement can lead to a denied claim.

For that reason, understanding the rules before you purchase or register a vehicle matters. This guide explains exactly what your corporation must do to claim GST/HST on a company vehicle while staying compliant with CRA expectations.

What the Law Says

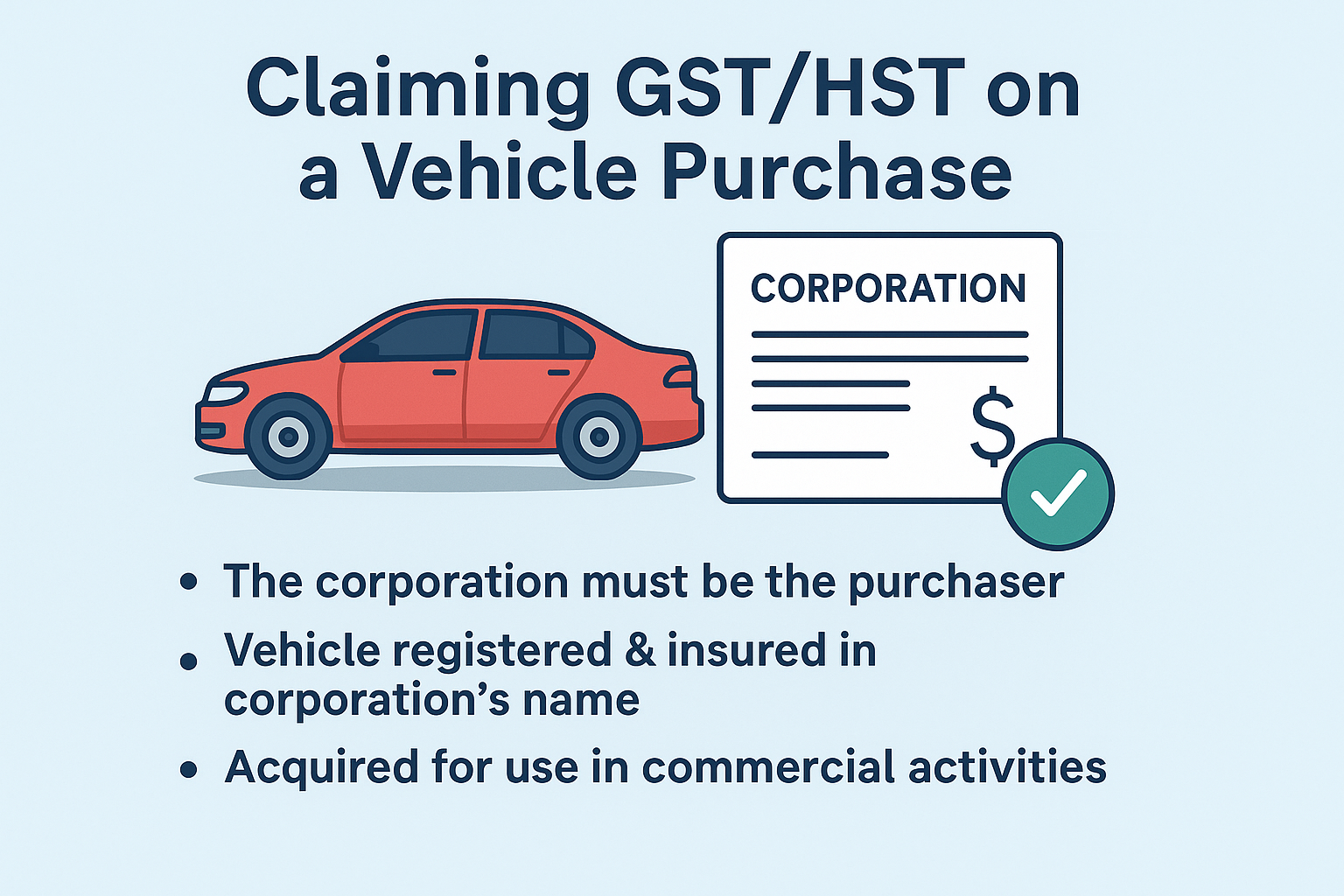

Under the Excise Tax Act, a corporation can only claim an input tax credit (ITC) for GST/HST if three core conditions are met:

-

The corporation has acquired the vehicle in its own name.

-

The GST/HST was payable or paid by the corporation.

-

The vehicle was acquired for use in the corporation’s commercial activities.

If your business fails to meet even one of these requirements, CRA will deny the ITC. As a result, many incorporated businesses lose GST/HST credits even though they use the vehicle for business purposes.

⚖️ What Recent Court Decisions Tell Us

A recent Tax Court of Canada case (1000025074 Ontario Inc. v. HMK, 2023-1836(GST)) highlights the importance of proper documentation. In that case, a real estate corporation claimed GST/HST on two vehicle purchases.

The CRA denied the ITCs, and the court agreed — because:

-

The vehicles were registered and insured under the shareholder’s name, not the corporation’s.

-

The bills of sale did not list the corporation as the purchaser.

-

The GST/HST was paid personally, not by the corporation.

The takeaway? Without proof that the corporation acquired, paid for, and used the vehicle in business activities, the ITC cannot be claimed.

Steps to Ensure Compliance

To properly claim GST on a company vehicle in Canada, follow these best practices:

-

Register the vehicle in the corporation’s name.

CRA treats registration documents as key proof of ownership. -

Ensure the insurance policy lists the corporation as the insured party.

This aligns legal ownership with the tax claim. -

Pay from the corporation’s bank account.

Payments made personally — even if reimbursed — weaken your claim. -

Keep detailed documentation.

Retain bills of sale, proof of payment, and insurance certificates in the corporation’s records. -

Track usage accurately.

Maintain mileage logs showing the business purpose of the vehicle to support your ITC claim.

Common Mistake: The Shareholder Vehicle

A frequent issue arises when a shareholder personally buys a vehicle, but the corporation claims the GST/HST. Even if the vehicle is used for business, CRA may deny the ITC because the purchaser on record and the payer of GST/HST are not the corporation.

Intent isn’t enough — the documentation must clearly demonstrate that the corporation owns and paid for the vehicle.

The Bottom Line

When claiming GST on a company vehicle in Canada, ensure that:

-

The corporation is the legal owner of the vehicle.

-

The GST/HST is paid by the corporation, not personally.

-

The vehicle is used in commercial activities with proper documentation.

By following these rules, your business can confidently recover eligible GST/HST while remaining fully compliant with CRA guidelines.

The information in this article is provided for general educational purposes only and should not be considered legal, accounting, or tax advice. The application of GST/HST and other tax rules can vary based on specific circumstances and may change over time. Readers should consult with a qualified professional advisor before acting on any information contained herein. Need help? Contact us at www.vhaccounting.ca.