The thought of a CRA audit can make even the most organized Canadian small business owner nervous. But the truth is, audits are not something to fear—if you’re prepared.

This blog breaks down what triggers a small business audit, what the Canada Revenue Agency (CRA) actually looks for, and how to make sure you’re ready if that audit letter ever arrives.

Why the CRA Might Audit You

CRA doesn’t pick businesses at random. Here are common audit triggers:

- Unusual or large expense claims (especially around travel, vehicle expenses and professional fees but really all apply)

- Consistently reporting business losses

- Income or expense fluctuations that don’t align with past filings or industry norms

- High home office, vehicle, or meals deductions

- Mismatch in GST/HST filings vs. income tax returns

- Third-party tips or previous audit flags

Pro Tip: Small Business Audits can happen even if you’ve done nothing wrong—sometimes it’s how your numbers appear, and other times, it’s simply the luck of the draw.

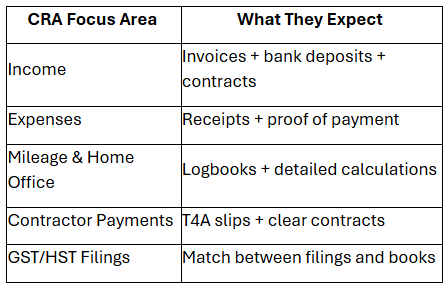

What the CRA Reviews in an Audit

The CRA’s goal is to verify whether you’ve accurately reported your income and claimed only legitimate expenses. Here’s what they’ll typically ask for:

Income Verification

- Business bank account statements

- Sales invoices and contracts (usually they will start with the top ten)

- The General Ledger showing all sales transactions

- Records of any barter or non-cash transactions

They may also require deposit records (including e-transfers and cash).

Expense Justification

- Deposit records (including e-transfers and cash)

- The General Ledger showing all expense recordings and allocation (or the specific one they are asking for if it is a directed review)

- Receipts and bills with full details

- Proof of payment (credit card, e-transfer, bank withdrawal)

Supporting Documentation

- Mileage logs for vehicle claims

- Internet, phone, and utilities bills (for home office claims)

- Lease agreements or property tax bills (for business premises)

- Payroll records if you pay employees (T4s, ROEs, remittances)

- T4A slips and contracts for contractors

CRA will expect original receipts (not just bank or credit card statements) and will disallow any claim they deem unsupported. The above may be expanded or reduced depending on the specific type of review or audit the CRA are conducting.

Red Flags That Get Extra Attention

Certain types of claims tend to attract closer scrutiny:

Vehicle Expenses

- Claiming business use of your vehicle? CRA expects a detailed mileage log.

- No log = high risk of disallowed deductions.

Home Office Expenses

- Must be your principal place of business or used exclusively and regularly for work.

- CRA wants square footage calculations, plus proof of eligible utilities, rent, or mortgage interest.

Meals & Entertainment

- Only 50% is deductible in general (some exceptions) and must be business-related.

- CRA expects receipt + purpose of meal + who attended.

Pro-tip document the business purpose right at the restaurant by writing on the receipt who you met with. Then scan it in to your bookkeeping system for audit-ready books.

Contractor vs. Employee

- Paying “contractors” but treating them like employees?

- CRA uses multiple tests (control, ownership of tools, risk) to determine the true relationship.

How to Be Audit-Ready (Always)

The best time to prepare for an audit? Before one happens. Here’s how:

1. Use Cloud Accounting Software

- Systems like Xero or QuickBooks Online help you stay organized.

- Real-time bank feeds and digital document attachment streamline your audit trail.

2. Digitize Your Receipts

- Use Hubdoc, Dext, or another app to upload receipts instantly.

- Paper fades, gets lost, or tears—digital doesn’t.

3. Keep a Mileage Log

- CRA prefers contemporaneous records.

- Use an app like TripLog or MileIQ to track business trips automatically.

4. Reconcile Regularly

- Monthly reconciliation keeps your books clean and reduces mistakes.

- It’s much easier than trying to fix things a year later during an audit.

5. Work With a Professional

- An experienced accountant can help spot audit risks before CRA does.

- They’ll ensure you’re classifying expenses correctly and saving every legitimate dollar.

Pro-tip: Vehicle expenses tend to be the most regularly audited item that we have seen in the past ten years with all indications that this will continue.

Final Thoughts

A CRA audit can feel intimidating—but it doesn’t have to be disruptive or damaging. If you’ve kept proper records, used automation, and worked with a knowledgeable advisor, you’re already ahead of the game.

And remember: being organized is the best audit defense.

Need Help Getting Audit-Ready?

At Virtual Heights Accounting, we help small business owners stay organized, compliant, and confident. From monthly bookkeeping to audit support, we’ve got your back.

Book a free discovery call today and let’s make tax season (and audits) feel easy.