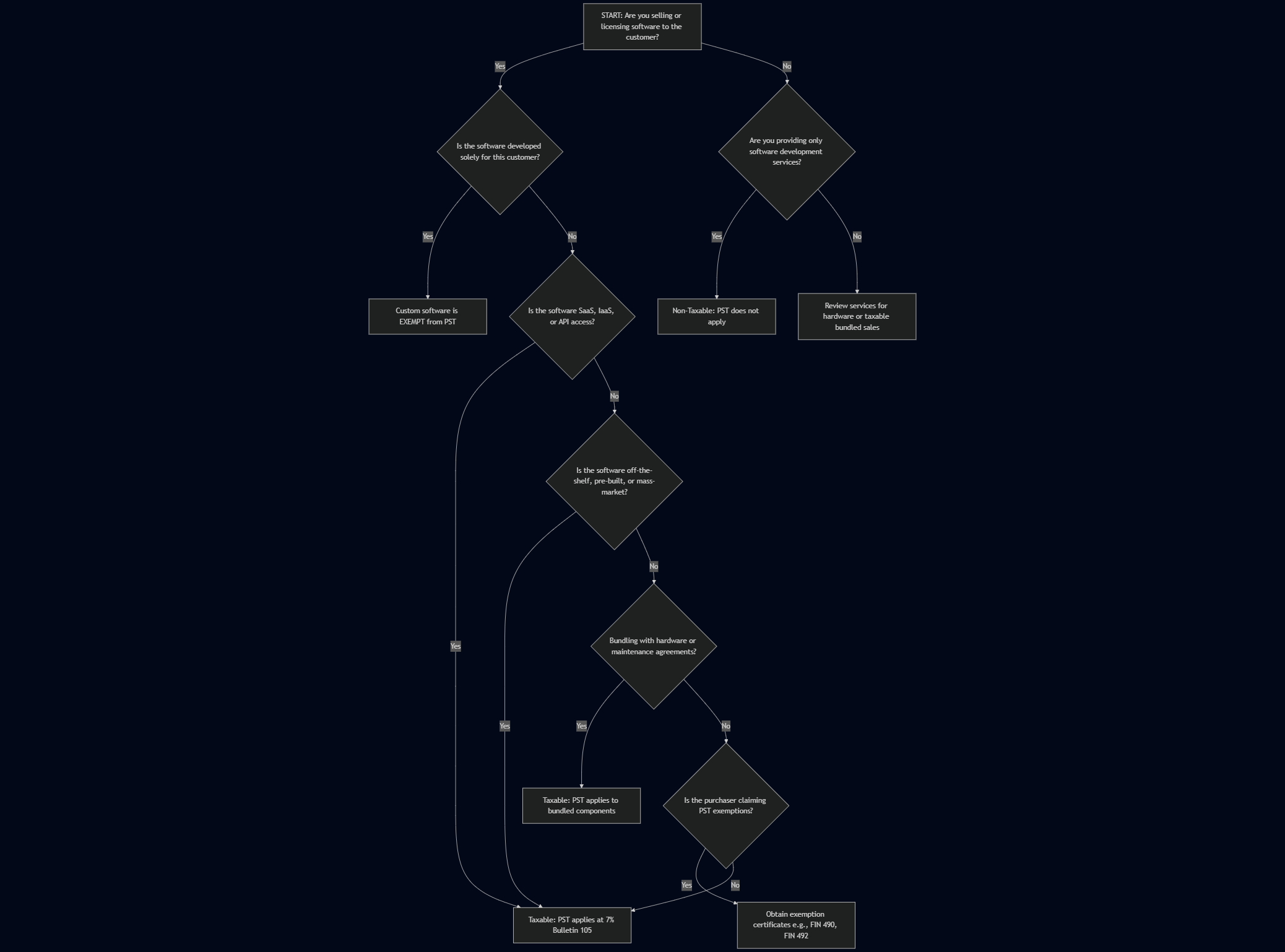

Decision Flowchart for Software Development Clients in British Columbia

This flowchart helps BC software developers, SaaS providers, and technology consultants determine whether they need to charge Provincial Sales Tax (PST) when selling or licensing software. Learn your responsibilities for collecting PST on your software sales.

It is based on the 2024 BC PST Bulletin 105.

Step-by-Step Guide:

-

Are you selling or licensing software to the customer?

-

Yes: Continue to the next step.

-

No: Skip to the question about software development services.

-

-

Is the software custom-developed solely for this client?

-

Yes: Custom software is exempt from PST.

-

No: Continue below.

-

-

Is the software delivered as SaaS, IaaS, or API access?

-

Yes: Taxable. PST applies at 7%.

-

No: Proceed to the next question.

-

-

Is it off-the-shelf or pre-built software?

-

Yes: Taxable. PST on Software Sales applies at 7%.

-

No: Check if you are bundling.

-

-

Are you bundling software with hardware sales or maintenance agreements?

-

Yes: Taxable. PST applies to all bundled components.

-

No: Continue below.

-

-

Is the purchaser claiming a PST exemption (e.g., resale, manufacturing, prototypes)?

-

Yes: You must obtain the correct exemption certificate (e.g., FIN 490 or FIN 492).

-

No: Taxable. PST applies.

-

-

Are you only providing software development services (consulting, programming, testing, configuration, or repair)?

-

Yes: Non-taxable. PST does not apply.

-

No: Review for any taxable bundled components.

-

For more details, refer to the official BC PST Bulletin 105 on Software.

Need more help? Contact Virtual Heights Accounting.

This blog is intended for general use and understanding. Specific cases can alter recommendations which are often based on current court cases. These recommendations may evolve as new court cases or CRA interpretations become available. Thus direct professional advice is always recommended to ensure you are getting the right information for you and your business.